IRS Form 6765 instructions explain how businesses calculate and claim the R&D Tax Credit by reporting qualified research expenses, choosing the correct method, and attaching proper documentation to their tax return

Form 6765 Instructions: A Clear and Practical Guide

Form 6765 can feel intimidating at first glance. It looks technical, asks detailed questions, and carries serious tax impact. Still, when you understand the logic behind it, the form starts to make sense.

This guide walks you through IRS Form 6765 instructions in a clean, human, and practical way. Every detail here relies on official IRS guidance and widely accepted tax practices. No assumptions. No filler. Just real help.

If you innovate, improve processes, or build new products, this form may reward your effort instead of draining your energy.

Table of Contents

What Is Form 6765 Used For?

What Is the R&D Tax Credit?

Who Files Form 6765?

Who Qualifies for R&D Tax Credit?

Understanding Qualified Research Expenses

Instructions for Form 6765 Structure

How Is Form 6765 Calculated?

ASC vs Regular Method Explained

Section 280C Reduced Credit Election

Can Startups Use Payroll Offset?

Form 6765 Section F Changes and 2025 Updates

What Documents Are Required?

How to File Form 6765 Correctly

Why Accuracy Matters for IRS Trust

Conclusion

Frequently Asked Questions

What Is Form 6765 Used For?

Form 6765 is used to calculate and claim the federal Research and Development Tax Credit. Businesses attach it to their income tax return to reduce tax liability or payroll taxes.

The IRS designed this form under Internal Revenue Code Section 41. The goal is simple. Encourage innovation inside the United States.

If your business improves products, software, manufacturing methods, or internal systems, Form 6765 may apply to you.

What Is the R&D Tax Credit?

The R&D Tax Credit rewards businesses that invest time and money into innovation. According to the IRS, qualified activities must involve technical uncertainty and a process of experimentation.

This credit applies across industries. Software, manufacturing, engineering, biotech, and even food development often qualify.

The credit reduces income tax or payroll tax, depending on eligibility. That makes it one of the most valuable credits available to growing businesses.

Who Files Form 6765?

Any business claiming the R&D Tax Credit files Form 6765. This includes:

C corporations

S corporations

Partnerships

Sole proprietors

Qualified startups

Who files Form 6765 depends on who incurs the research expenses. The entity paying wages and costs claims the credit.

Who Qualifies for R&D Tax Credit?

Many businesses assume they do not qualify. That assumption costs them money.

You may qualify if your activities aim to:

Develop or improve a product or process

Resolve technical uncertainty

Use engineering, computer science, or physical sciences

Follow a trial and error approach

The IRS focuses on activity, not company size. Startups and small businesses qualify as often as large corporations.

Understanding Qualified Research Expenses

What are QREs?

Qualified Research Expenses form the foundation of Form 6765 calculations.

The IRS recognizes three main categories:

Wages paid to employees performing research

Supplies consumed during research

Contract research costs, partially allowed

Only expenses tied directly to qualified activities count. Marketing, sales, and general admin costs do not qualify.

Instructions for Form 6765 Structure

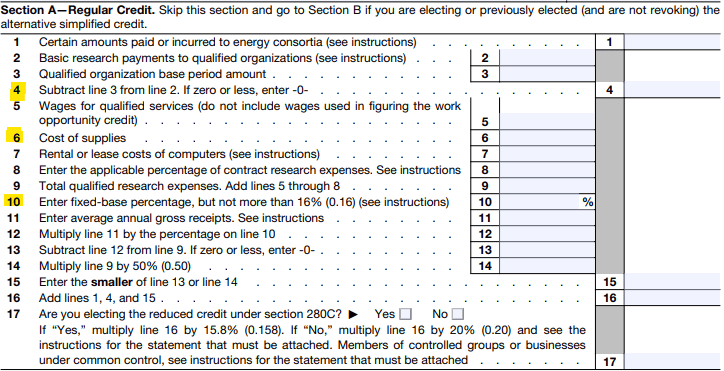

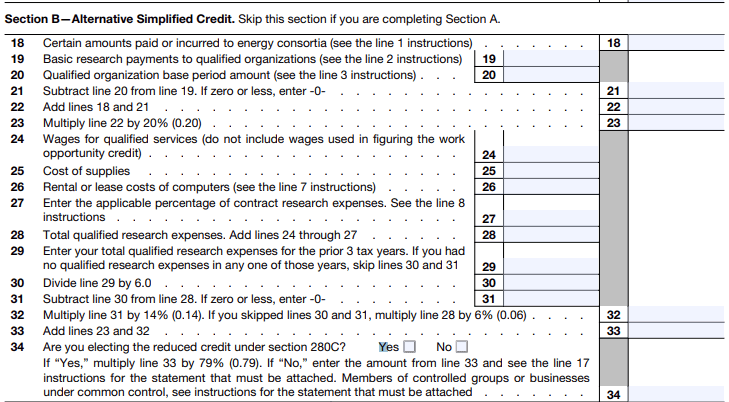

IRS Form 6765 instructions divide the form into clear sections.

Section A calculates the regular credit

Section B calculates the alternative simplified credit

Section C handles current year credit

Section D addresses payroll tax election

Section E applies for controlled groups

Section F requests detailed business information

The revised Form 6765 places more emphasis on transparency and consistency.

Note: IRS form list is a complete collection of official tax forms used to report income, claim credits, and meet federal tax filing requirements accurately and on time.

How Is Form 6765 Calculated?

How is Form 6765 calculated?

The answer depends on the method you choose.

The IRS allows two methods:

Regular Credit Method

Alternative Simplified Credit method

Each method uses QREs but applies different formulas. The IRS provides detailed worksheets in official instructions.

Choosing the correct method affects credit size and audit risk.

ASC vs Regular Method Explained

Section 280C Reduced Credit Election

The Section 280C reduced credit election allows taxpayers to reduce deductions instead of reducing the credit amount.

This election simplifies reporting and avoids amended returns. Many businesses choose it for cleaner tax filings.

Once elected, consistency matters. Switching methods requires careful planning.

Can Startups Use Payroll Offset?

Yes. Can small business elect payroll tax credit on Form 6765? Absolutely.

Qualified startups can apply up to a statutory limit of the R&D credit against employer payroll taxes. This option supports cash flow during early growth stages.

The IRS defines a qualified startup based on gross receipts and years in operation.

Form 6765 Section F Changes and 2025 Updates

What changed in 2025? The IRS introduced expanded disclosures under Form 6765 Section F changes.

Section F now asks for:

Business component descriptions

Research activity categories

Expense breakdowns

What new information must be reported on IRS Form 6765 beginning in 2026 will go even further. The IRS confirmed future requirements through official releases.

These changes aim to reduce vague claims and improve compliance.

What Documents Are Required?

What documentation is required for the R&D Tax Credit? Documentation supports your claim if the IRS asks questions.

Common documents include:

Payroll records

Project descriptions

Technical notes

Expense reports

Contracts with researchers

The IRS does not require a specific format. They require credibility and consistency.

Improving financial literacy helps businesses prepare better records. This insight aligns with the data discussed in this guide on Financial Literacy Statistics.

How to File Form 6765 Correctly?

How to file Form 6765 depends on your entity type. You attach the form to your federal income tax return.

Most taxpayers file electronically using IRS approved software. Accuracy matters more than speed.

If the form feels overwhelming, professional help saves time and reduces risk.

BooksMerge supports businesses with accounting, tax compliance, payroll, and data migration services. Their team focuses on accurate filings and audit ready documentation. You can reach them at +1-866-513-4656.

Why Accuracy Matters for IRS Trust?

The IRS values consistency and transparency. Clean Form 6765 instructions followed correctly reduce audit risk.

Errors usually happen due to rushed calculations or weak documentation. Logic beats guesswork every time.

Clear reporting builds trust with the IRS and confidence for your business.

Conclusion

Form 6765 instructions exist to guide, not punish. When businesses understand the purpose behind the questions, compliance becomes manageable.

The R&D Tax Credit rewards real innovation. If you invest in improvement, you deserve to explore it properly.

With accurate data, proper documentation, and expert support, Form 6765 becomes an opportunity, not a headache.

Frequently Asked Questions

Read Also: Form 6765 Instructions